Woodside Energy production and revenue in the second quarter rose to 60% and 44% respectively from the first three months of 2022, and this was helped by the contribution from BHP’s petroleum business.

According to the company, the Production for the period under review was 33.8 million barrels of oil equivalent, while revenue climbed to $3,438 million on the back of a 51% increase in sales volume to 35.8 million barrels of oil equivalent. The completion on 1 June of our merger with BHP’s petroleum business was the highlight within the period and this has transforming Woodside into a top 10 global independent energy producer by hydrocarbon production, and making it the largest energy company listed on the Australian Securities Exchange.

Woodside received a net cash payment from BHP Group of approximately $1.1 billion, which included the cash remaining in the bank accounts of BHP Petroleum immediately prior to completion. The merger was overwhelmingly endorsed by Woodside’s shareholders at our Annual General Meeting in May, and they are now seeing first evidence of the increased financial and operational strength the transaction will deliver.

The subsequent listings of Woodside shares on the New York and London stock exchanges were historic moments for the company, reflecting our more diverse shareholder base. Significant progress was made on key projects during the quarter. All major equipment items for Scarborough have been procured and construction has begun at the Pluto Train 2 site.

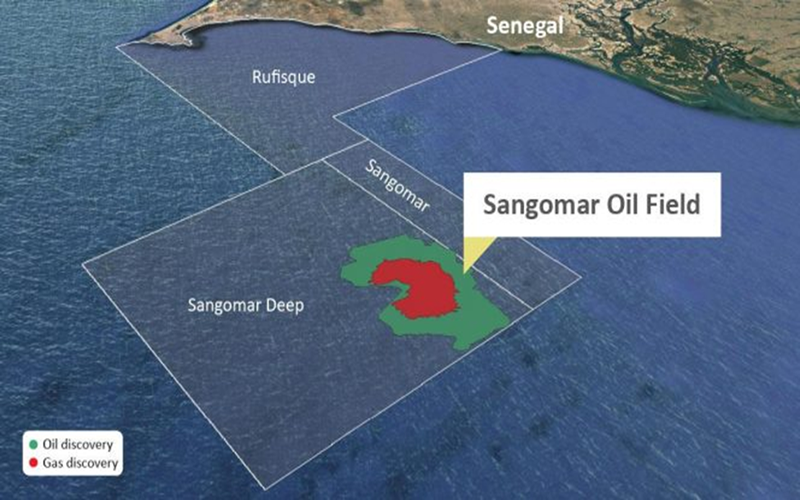

First steel for Scarborough’s floating production unit topsides was cut, pipeline manufacturing is 25% progressed and the subsea trees for initial start-up of the project are all complete. Installation of the mooring system for the floating production, storage and offloading facility at the Sangomar field has been completed and the second drillship, the Ocean BlackHawk, commenced drilling in July.

Sangomar Field Development Phase 1

• The Sangomar Field Development Phase 1 was 63% complete at the end of the period.

• Installation of the mooring system in the Sangomar field for the floating production storage and offloading (FPSO) facility was successfully completed in July 2022.

• The development drilling program is progressing and the second drillship, the Ocean BlackHawk, commenced drilling in July 2022.

• The FPSO is expected to be relocated in October 2022 from the current shipyard in China to the Keppel Shipyard in Singapore to complete commissioning

• The subsea installation campaign is planned to commence in Q3 2022. Woodside is ending the current sell-down process for Sangomar.

“Following extensive discussions with potential new partners, we have decided to discontinue the sell-down of equity in Sangomar. “In Australia, accelerated Pluto gas transported through the Pluto-Karratha Gas Plant Interconnector has resulted in additional LNG production and sales of uncontracted cargoes in a high-priced market. “Lambert Deep, a component of the Greater Western Flank Phase 3 project, achieved ready for start-up in July,” CEO Meg O’Neill said.