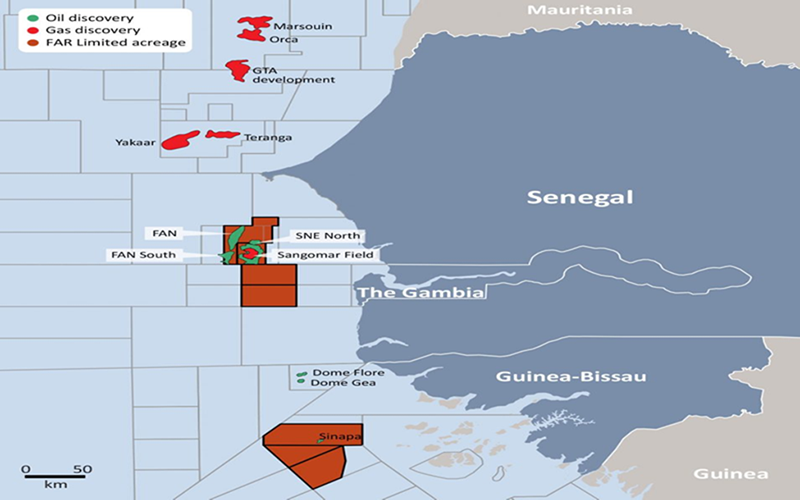

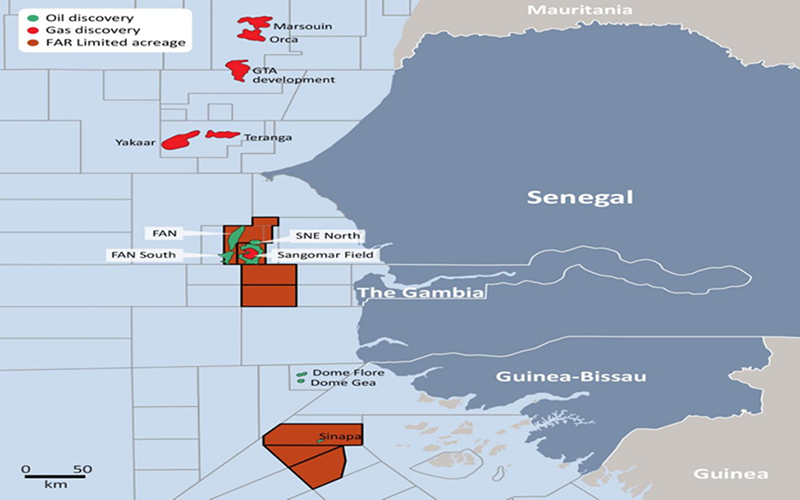

On 19 January 2021 the FAR group executed a Sale and Purchase Agreement with Woodside in relation to FAR’s Senegal RSSD asset.

Formal completion of the sale took place on 6 July in Senegal and monies were received by FAR in Australia on 7 July. As consideration for the sale Woodside has paid FAR US$45 million and reimbursed FAR’s share of working capital for the RSSD Project from 1 January 2020 of approximately US$82 million, totalling US$126 million (including deductions for interest charged on outstanding cash calls).

Following the completion of the sale to Woodside, FAR has no remaining interest in the RSSD licences offshore Senegal.

Pursuant to the Sale and Purchase Agreement with Woodside, future payments to FAR, up to US$55 million, are contingent on future oil price and timing of first oil. First oil is targeted for 2023.