Invictus Energy has announced a private Placement to raise $10.0m, at $0.12 per share, following the Company’s decision to advance preparations for an appraisal and exploration campaign in Zimbabwe’s Cabora Bassa Basin.

“I am pleased with the backing Invictus has received from both existing and new shareholders as we prepare to follow up the successful Mukuyu-1 exploration campaign.

“The Placement was oversubscribed and cornered by long-term investor Mangwana Capital, as well as a number of local Zimbabwe partners and the Board.

“Preparations of our Phase 2 exploration and appraisal campaign at the Cabora Bassa Project are well advanced, with the 2D seismic campaign anticipated to kick off in May.

“This seismic campaign will help mature multiple identified leads in the proven fairway into drill ready prospects, both along trend from Mukuyu and in the highly prospective Basin Margin play.

“We also remain on track to spud the Mukuyu-2 appraisal well in the third quarter of 2023, targeting multiple hydrocarbon (gas-condensate and potentially light oil) bearing intervals encountered in the Mukuyu-1/ST1 well in the Upper Angwa, Pebbly Arkose and Post Dande formations.

“Again, I would like to thank existing shareholders that participated in the Placement for their continued support and would like to welcome new investors that are joining our journey,” Managing Director Scott Macmillan commented.

Use of funds

Proceeds from the Placement will be used to fund the preparations for the Mukuyu-2 appraisal well program and Phase 2 exploration program:

- Preparation for Mukuyu-2 Well (including long lead items)

- 2D Seismic & Processing of Eastern leads on trend with Mukuyu to drill ready targets

PAC Partners acted as the lead manager, with Evolution Capital acting as Co-Managers and book-runner to the Placement and will be paid a management fee of 2 per cent and a selling fee of 4 per cent for the Placement funds received. PAC Partners and Evolution Capital will receive lead manager listed options on a ratio of one-for-eight, and on the same terms as the placement attaching options. Lead manager options will be issued under the Company’s ASX Listing Rule 7.1 allowance.

Mukuyu-2 Overview & 2D Seismic

Preparations for the Mukuyu-2 appraisal program and Cabora Bassa Phase 2 exploration campaign are well advanced.

The 2D seismic acquisition program is anticipated to commence in May, pending the award of seismic contract, and will cover the eastern portion of EPO 1848 & 1849, incorporating the Company’s experience from the successful CB21 Seismic Survey acquisition.

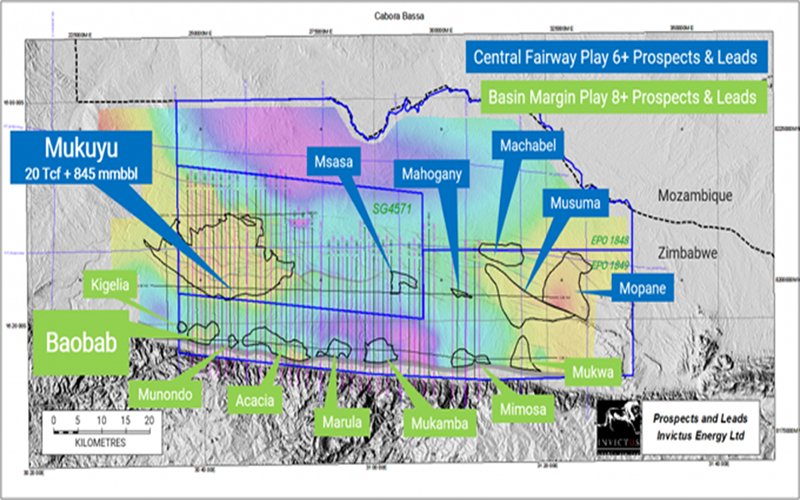

The new seismic campaign will be aimed at maturing multiple leads (Mopane, Musuma, Machabel and Mahogany) along the proven play on trend to the east of Mukuyu and additional leads along the highly prospective Basin Margin play (Mimosa and Mukwa), as per Figure 1.

The acquisition of modern 2D seismic will likely allow the Company to mature a number of these leads, previously identified on reprocessed vintage seismic data, to drillable prospects.

Drilling of the first well in the Mukuyu appraisal program, Mukuyu-2, also remains in line with prior guidance, with an anticipated spud date early in the third quarter of 2023.

Mukuyu-2 will target multiple hydrocarbon (gas-condensate and potentially light oil) bearing intervals encountered in the Mukuyu-1/ST1 well in the Upper Angwa and Pebbly Arkose formations, as detailed in the ASX release on 23 January, with the aim of confirming a gas-condensate discovery.

The appraisal well will also aim to test the Post Dande horizon away from the major east-west fault on the southern flank and the deeper potential in the remaining Upper Angwa formation, which was not encountered in the Mukuyu-1/ST1 campaign due to it being thicker than pre-drill estimates, providing further upside potential.

The Mukuyu-1/ST1 well encountered gas pay to total depth, interpreted from wireline logs and fluorescence in multiple reservoirs throughout the 1,500-metre interval penetrated in the Pebbly Arkose and Upper Angwa.

The well design for Mukuyu-2 will incorporate valuable experience gained from the drilling of the successful Mukuyu-1/ST1 exploration well to improve drilling efficiency and lowering operational risks.

The maintenance and upgrade program for Exalo’s Rig 202 is commencing this month and will be completed prior to the rig move and spud of Mukuyu-2.

The long lead and well services tenders are in progress and the Company has pleasingly received confirmation that all major service providers will be submitting proposals for the upcoming campaign, allowing the Company to tailor the service provision for Mukuyu-2.