The recent disclosuremade by the Group Managing Director of Nigerian National Petroleum Company NNPC Mallam Abba Kyariat just concluded Nigerian International Energy Summit (NIES 2022) in Abujathat International oil companies are leaving Nigeria and shifting their investment portfolios to more added value towards carbon net-zero commitment has taken a vivid dimension.

“This sale will allow us to prioritize competitively advantaged investments in our strategic assets, and it supports the Nigerian government’s efforts to grow its oil and gas operations,” said Liam Mallon, president, ExxonMobil Upstream Oil and Gas. “We value the relationships we have spent decades building with the government and people of Nigeria, which will continue as we maximize the value from our deepwater operations,” the company stated.

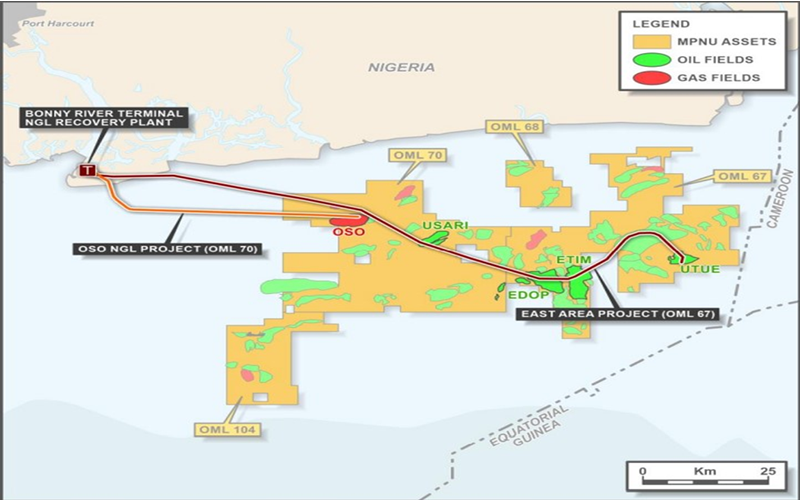

When finalized, the sale will include the Mobil Development Nigeria and Mobil Exploration Nigeria equity ownership of Mobil Producing Nigeria Unlimited, which holds a 40% stake in four oil mining licenses, including more than 90 shallow-water and onshore platforms and 300 producing wells.

ExxonMobil further said that it will maintain a significant deepwater presence in Nigeria, including interests in the Erha, Usan and Bonga developments via Esso Exploration and Production Nigeria Limited and Esso Exploration and Production Nigeria (Deepwater) Limited, and the sale will not result in any loss of employment and is expected to close later this year subject to regulatory and other approvals.

But the NNPC boss in contrary at the event disclosed that the company is currently discussing this latest divestment plan by ExxonMobil to sell its onshore oil assets in the country.

“Companies are divesting. They are leaving our country. That is the best way to put it. They are not leaving because opportunities are not here but because companies are shifting their portfolios where they can add value and not just that, but where they can also add to the journey towards carbon net-zero commitment,” Mr Kyari said.

Although Seplat Energy has announced that it has entered into a contract with Exxon Mobil to buy Mobil Producing Nigeria Unlimited’s entire oil assets in Nigeria, which include all of ExxonMobil’s entire shallow water assets in the Niger Delta.

NNPC Acquisition Plan

But the recent feelers reaching Oilfield Africa Review is pointing towards different angle disproving the previous claim made by ExxonMobil as the deal has met a serious obstacle from NNPC having the right of pre-emption

According to information available at the public domain, Nigerian National Petroleum Company Ltd has written to Mobil Producing Nigeria Unlimited highlighting its intention to exercise a Right of Pre-emption on ExxonMobil’s planned sale of its asset.

ExxonMobil had said the sale will support the company’s disciplined investment strategy, an effort to enhance industry participation in green energy investment which will enable the company meet its net-zero targets.

The ExxonMobil projected assets sale include more than 90 shallow-water and onshore platforms and 300 producing wells. Seplat was selected to buy the above mentioned ExxonMobil’s stake of $1.3bn, a deal which could ultimately reach around $1.6bn under certain conditions.

But the NNPC according to a letter from the Group Managing Director, Mele Kyari has notified Mobil Producing Nigeria Unlimited of its intention to exercise a Right of Pre-emption on the planned sale of its entire asset in Nigeria’s onshore and shallow waters.

Sequel to this investment interest, the NNPC boss Mallam Abba Kyari in his speech at the just concluded NIES Event held in Abuja Nigeria exonerated ExxonMobil divestment plan as call in right direction, pointing the prevailing global quest for green energy investment portfolios as the current reality of fact’ “We can’t do without financing and we also know that there is a shortage of financing in this respect. Therefore, for us in NNPC, we are here to serve you. We are here to facilitate this process. We will work with our partners, and of course, you are seeing some of the consequences,’’ NNPC Group MD, Mr Kyari said.

“We understand the necessity for divestment. We do know that there are issues. We understand that this must take place but also that it must be done in such a way that we can deal with issues around decommissioning and also make sure that whatever arrangement that is put in place ensures that we are also aligned along the energy transition journey that we are going to,” He added.

PIB, Acquisition and Right of Pre-emption

Right of pre-emption is a legal right to parties in a joint venture to be the first to be considered for any planned sale or takeover of assets in the Joint Ventures JVs if either partychooses to trade them off. And the latest decision from the NNPC implies that the Sales Agreement between SEPLAT and ExxonMobil will no longer continue.

In the letter signed by Kyari, and addressed to ExxonMobil, the NNPC reiterated its resolve to take over the ExxonMobil’s share of the assets.The letter reads in part, “We are aware that you reached an agreement to divest from onshore and shallow waters JVs,clearly we are interested.”

Following the implementation of the Petroleum Industry Act, the NNPC in the letter stated that it has been transformed from being a corporation to a profit driven company.The National Oil Company, according to the letter now has the capacity to buy over the share of ExxonMobil in the Joint ventures.

The NNPC is currently being positioned to be the most capitalized company in Africa as the PIA has provided business opportunities that will enable the National Oil Company earn more revenue for the country.

The Group Managing Director of the Nigerian National Petroleum Company Ltd, MrMeleKyari, has recently in same event said that with the implementation of the Petroleum Industry Act, the Company will emerge the fifth largest gas producing in the world.

Kyari stated this in Nigerian International Energy Summit in Abuja, with the theme: “Revitalising the Industry: Future fuels and energy transition.”

The new PIA legislation has provided business opportunities that will enable the NNPC earn more revenue for the country and attract foreign direct investment into the Nigerian energy sector.The PIA has also raised stakeholders’ expectations on the company, even as it has given it a wide room to stimulate investments in the oil and gas industry.

The new legislation has provided business opportunities that will enable the NNPC earn more revenue for the country and attract foreign direct investment into the Nigerian energy sector

The dividend of the recent passage of Nigeria Petroleum Industrial Act has started yielding result after years of its contention at the country’s National Assembly. The Nigerian National Petroleum Company Ltd has announced the secured of a $5bn corporate finance commitment from the African Export Import Bank to fund major investments in Nation’s upstream sector.

The funding commitment is a fallout of the meeting between the Chairman of the Board of Directors and President of the African Export-Import Bank (Afreximbank), Prof Benedict Oramah; and the NNPC Ltd team led by the Group Managing Director/Chief Executive Officer , Malam Mele Kyari, in Cairo, Egypt recently.

The NNPC’s $5bn corporate finance commitment from Afreximbank is seen by oil industry stakeholders as a dividend of the Petroleum Industry Act and the incorporation of the NNPC as a limited liability company. The recent funding will invariably increase stakeholders participation in the country upstream investment portfolio thereby cushioning the perceived bottlenecking and growth issues hindering offshore rig activities, and drilling campaigns in the oil industry as well Joint Venture financial delay.

Under the NNPC Ltd funding strategy for selected upstream investments, the Company had raised between $3.5bn and $5bn as corporate finance to fund major upstream investments.

To achieve this objective, the NNPC would be taking over ownership from non-investing partner through acquisition of pre-emption rights in the sample Joint Venture.

The NNPC’s strategy would also see the company investing in assets to address integrity, bottlenecking and growth issues including rig-less activities, and drilling campaigns in the oil industry.The funding would also be used to finance part of the NNPC’s investment including acquisition of interest in quality upstream oil and gas producing assets.

The acquisition is an integral part of the NNPC’s corporate strategy to rebalance its portfolio by divesting from some toxic assets to acquire choice strategic assets that will help support its long-term strategic objectives.

Nigeria Era of Gas is here

Speaking further at the Nigerian International Energy Summit event, Kyari told investors that with the new legislation, the NNPC is currently better positioned to play its role in ensuring energy security for the country.Nigeria launched its decade of gas in February last year in a move to transition into clean energy and as well eliminate energy poverty, eating up about 40 per cent of its population.

The NNPC is currently deepening natural gas utilisation to reduce energy poverty through the National Gas Expansion Programme and intensifying the use of petrochemicals.The National Company is also making concerted efforts in the Gas sector through various projects such as NLNG Train 7, AKK, OB3, ELPS and others.

It is also involved in the expansion and integration of domestic/regional power grids and growing the domestic gas markets through Autogas/Compressed Natural Gas/Liquified Petroleum Gas to power vehicles.

“This company is important for all of us. It is a company that by law is meant to guarantee energy security for this country. So, it is the company that has that obligation-that you must guarantee energy security for this country. In its widest context, energy security means many things. Its not just about providing PMS to the country but energy is energy,” NNPC Group MD, MrKyari stated.

“It means that this country must drive the roads to renewables, to clean energy and net zero carbon situation and to drive prosperity in this nation. We cannot drive prosperity without energy. So, this company by implication is expected to drive the economic growth of this country.And that can’t work except we collaborate and have the right climate for doing this. So, this law today by all standards is sufficiently competitive, our framework is competitive, our regulatory framework is world class and more than that, it has shown is that when you put your money, you can get your money back with some margin,” He concluded.

SHELL’S DIVESTMENT OF ENTIRE NIGERIA JV ASSETS

Shell and Nigeria go back a long way – but net zero plans are leading to a clean break from Niger Delta assets. Shell has been active in Nigeria since the 1930s. It’s no exaggeration to say that Nigeria helped transform the company into the supermajor IOC we know today.

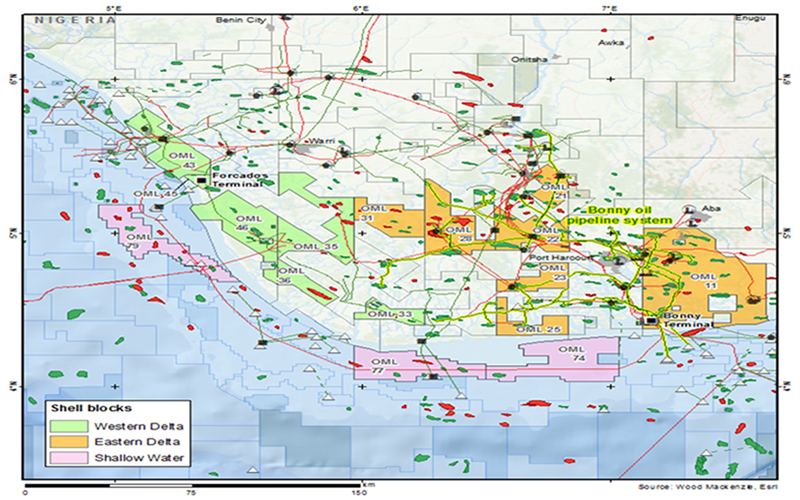

Now, 63 years after producing its first barrel in Nigeria, Shell plans to divest all of its operated joint venture (JV) licences held by the Shell Petroleum Development Company (SPDC). This includes a 30% interest in 19 oil mining leases (OMLs), according to Wood Mackenzie opinion report.

This is a radical step which would have seemed unlikely only 12 months ago, but is highly symbolic of what the energy transition means for IOCs in Africa.ExxonMobil could also divest its 40% stake in its JV with NNPC. Although the company has not set a net-zero target, its shallow water assets are high-cost, high-emission assets which are in steady decline.

Transition Energy and re-Investment outlook

Emissions from Shell’s assets in the onshore and shallow water Niger Delta are among the highest in its global portfolio. This is because of ageing infrastructure, under-investment, vandalism, continued flaring and the harsh operating conditions.

Until now, Shell has sold oil blocks but kept gas blocks supplying NLNG. This has changed, perhaps surprisingly, given that Shell seeks 55% gas in its global portfolio by 2030. Shell’s gas assets have the lowest emissions intensity within the JV, although still comparatively high compared with its global average.

The integration of these assets with oil infrastructure coupled with the ever-present security risks may have further persuaded Shell that a clean break from the onshore delta is, on balance, preferable.

Rather than sell single OMLs, Shell is seeking buyers for asset packages in the eastern, western and shallow water delta.

Shell’s JV assets in Nigeria

NNPC’s pre-emptive right paramount

Before all that though, Shell must negotiate with NNPC (holder of 55% in the JV assets), on the terms of a sale. This could cover NNPC’s pre-emption rights, treatment of outstanding JV liabilities including decommissioning, the fate of the JV’s terminals, transfer of staff and host community approval.

Shell’s priority is identifying credible buyers and ensuring deal completion. It wants to limit negotiations to hand-picked bidders, thus avoiding a long drawn-out process. But it needs NNPC’s buy in.

Indigenous EP Companies acquisition portfolios

Who wants high-cost, emissions-intensive assets in the Niger Delta? Not many. Yet Nigerian independents and new entrants are eager to acquire under-invested assets with plenty of volume upside. Playing at home, their acceptance of risk differs markedly from international E&Ps, so there will be few in the latter category. But in the energy transition era, can bidders raise enough finance to a) acquire, and b) invest in, a challenging portfolio of swampy assets?

Deal financing will be necessarily complex to mitigate risks. The recent OML 17 transaction highlighted that with a consortium of buyers backed by local and international lenders with multiple layers of debt.

Shell itself may provide finance to help smooth deals. It may even maintain an indirect interest in the OMLs, coupled with a clear exit strategy. This would get assets off the balance sheet, and provide more comfort to lenders. Innovative solutions will be needed.

A complete sell-off would be historic. However, all 19 OMLs will be extremely hard to shift in the current environment. Expressions of interest are due by 10 September.

Acquisition enablers

There could be as much as 4 billion boe (30% net) across the JV portfolio. However, we consider only 20% to be commercial due to a lack of investment, crude theft, insecurity and gas market constraints. Five of the OMLs are undeveloped.

A competent buyer/operator, giving priority to the assets, could commercialise much more than 20% of the resource base. The availability of funding for the JV partners will, as ever, dictate how much.

The recently passed Petroleum Industry Bill (PIB) overhauls the fiscal regime in Nigeria offering materially lower oil royalties and taxes. Hence, there is much more upside than downside which bidders will need to carefully quantify.

After decades of dominance in Nigeria, Shell is preparing for a new era with a much smaller, advantaged portfolio.

Shell OMLs in Nigeria at glance

OML 11 (inc.Ogoniland)OML 11 lies in the southeastern Niger Delta and contains 33 oil and gas fields of which eight are producing. In terms of production, it is one of the most important blocks in Nigeria. The terrain is swamp to the south with numerous rivers and creeks. Port Harcourt is located in the northwest of the block, while the major yard and logistics base at Onne is located by the Bonny river. The Bonny oil terminal – the largest in Nigeria – and Nigeria LNG (NLNG) are both located at Bonny Island …

OML 20OML 20 is a small onshore licence within the NNPC/Shell JV. It is the most northerly block in the JV and is located 100 kilometres north of Port Harcourt. It contains four mature producing fields: Egbema, Egbema West, Oguta and Ugada, which combined produced over 70,000 b/d in the 1970s.NNPC’s E&P subsidiary the Nigeria Petroleum Development Company (NPDC) is the operator of Egbema and Egbema West. Operatorship was transferred in 2005 to allow NPDC to build its technical capacity, …

OML 21 (Assa North)OML 21 is an onshore lease within the NNPC/Shell JV. The block is located 40 kilometres northwest of Port Harcourt. Six oil and gas discoveries have been made: Ahia, Assa, Assa North, Nkisa, Amapu and Awara. Only Ahia is producing. Crude is exported by pipeline southwards to the Rumuekpe manifold on OML 22. Here, it enters the Trans-Niger Pipeline, which delivers crude to Shell’s Bonny oil terminal. Assa North gas projectAssa North is the first of seven key domestic gas projects which …

OML 22 (Enwhe)OML 22 is located onshore Nigeria, 20 kilometres northwest of Port Harcourt in the eastern delta. The block lies outside the near-shore swamp of the Niger Delta and the drier terrain makes the area more favourable for operating. Shell is the operator and it is part of the NNPC-Shell Joint Venture (JV).OML 22 contains five developed fields: Ubie, Mini Nta, Obele, Enwhe and Rumuekpe, which have a sporadic production history. Production started in 1971 on the Obele field.

OML 23 (Soku)OML 23 lies in the eastern delta and is part of the NNPC/Shell Joint Venture (JV). The licence contains one producing field, Soku, which has been a major gas supplier to Nigeria LNG (NLNG) since 1999. Soku is located in a coastal swamp zone, around 40 kilometres southwest of Port Harcourt. The field facilities are mounted on piled platforms and can only be reached by boat or helicopter. Combined, OML 23 and OML 28 account for around 80% of the Shell JV’s gas supply to NLNG, although …

OML 25OML 25 lies 50 kilometres southwest of Port Harcourt in the onshore eastern delta and is part of the NNPC/Shell Joint Venture (JV). The block is located on the coastal mangrove swamp and extends slightly offshore. It is intersected by the Santa Barbara and San Bartholomeo rivers, which are large deltaic tidal channels that enter the Gulf of Guinea. The riverine and swamp environment makes for difficult operating conditions. Field facilities are mounted on semi-submerged piled platforms and …

OML 27OML 27 is a small onshore block in the central Niger Delta. It is part of the NNPC/Shell Joint Venture and contains the Adibawa, Adibawa Northeast and Biseni fields. Biseni straddles OML 27 and neighbouringEni-operated OML 61 where it is known as Samabri. It contains substantial contingent gas resources. Adibawa and Adibawa Northeast are currently producing but the block contributes very little towards the JV’s total production. Production is gathered at the Adibawaflowstation and is .

OML 28 (Gbaran-Ubie)OML 28 is an onshore block in the central Niger Delta. It is part of the NNPC/Shell Joint Venture (JV). The block contains Gbaran-Ubie, a major integrated oil and gas project. Gas production started in 2010 and by 2011, it had reached its initial capacity of 1,050 mmcfd of gas. Gbaran-Ubie is by far the most important Nigeria LNG (NLNG) feedstock project in the JV. Phase 1 covered four fields: Gbaran, Kolo Creek, Etelebou and Zarama. They are connected to a central processing facility (CPF) …

OML 31OML 31 is a large block in the central Niger Delta. Belonging to the Shell JV, the block has six discoveries which remain undeveloped. The operating conditions are difficult, as OML 31 is bisected by numerous creeks, with access only possible by helicopter or boat. Most of the fields lie within 20 kilometres from Shell’s Gbaran-Ubie development on neighbouring OML 28. The block is very gas prone but a development has never proceeded due to the small size of the resources.

OML 32OML 32 is an onshore licence which is part of the NNPC/Shell Joint Venture (JV). The block is located in the central Niger Delta about 80 kilometres east of Port Harcourt. The block contains two producing fields, Diebu Creek and Nun River, and one undeveloped field, Diebu Creek East. The block’s terrain is mostly riverine. The Nun River is the largest within the Niger Delta and the 500-600 metres wide channel bisects OML 32. The Nun River and Diebu Creek flowstations are mounted on

OML 33OML 33 is a small block in the remote swamps of the southern Niger Delta. Belonging to the Shell JV, the block has three discoveries which remain undeveloped. The operating conditions are difficult, as OML 33 is bisected by numerous large river channels, with access only possible by helicopter or boat. The block is very gas prone but despite its potential, a development has never proceeded. Although there have been attempts to revoke OML 33 from Shell due to lack of investment,

OML 35OML 35 is a large onshore block within the NNPC/Shell Joint Venture (JV). It lies in the southern swamps of the western delta. There are six producing fields in the southwest of the block: Benisede, Opukushi and Opukushi North, Opomoyo, Kanbo and Seibou. A large flow station at Benisede collects crude from Benisede, Opomoyo and Akono on OML 46. Together, this cluster is known as the Benisede Catchment Area (BCA). OML 35 can contribute 20% of the JV’s liquids production,

OML 36OML 36 is a large block located in the remote swamps of the southern Niger Delta. Belonging to the Shell JV, the block has one discovery Opugbene, which remains undeveloped. The operating conditions are difficult, as OML 36 is bisected by numerous large river channels, with access only possible by helicopter or boat. Insecurity and vandalism is a major issue particularly close to Eni’sTebidaba facilities on neighbouring OML 63. The block is gas prone

OMLs 43 & 45 (Forcados-Yokri)OMLs 43 and 45 lie in the northwest Niger Delta and are part of the NNPC/Shell Joint Venture (JV). The blocks straddle the Benin, Escravos and Forcados river estuaries. The blocks’ facilities are both offshore and onshore. OML 43 has five developed fields: Afremo, Escravos Beach, Forcados-Yokri, Otumara and Saghara. Forcados-Yokri is one of the biggest oil and gas fields in the JV. Production started in 1970 with the other fields shortly thereafter. Total production peaked in 1974 at …

OML 46OML 46 is a large block in the southwestern Niger Delta and is part of the NNPC/Shell Joint Venture (JV). The terrain is mangrove swamp, and numerous rivers and creeks intersect the block. There are eight discoveries on OML 46, four of which were developed in the 1990s: Agbaya, Akono, Ogbotobo and Tunu.Although OML 46 has significant oil and gas resources, the operating conditions are very challenging with vandalism and militancy are an ever-present threat.

OMLs 74 & 77OMLs 74 and 77 are two large shallow water licences in the eastern part of the Niger Delta and are part of the NNPC/Shell Joint Venture. There are eight undeveloped oil and gas discoveries on the block. Although the operator completed development plans for OML 74 and 77 (also known as H-Block and J-Block respectively), Final Investment Decision (FID) has not been taken. Despite the reserves potential of OMLs 74 and 77, the fields have remained undeveloped. A major barrier has been NNPC’s funding constraints, which has severely limited spend on upstream developments, particularly greenfield offshore projects. With Shell shifting focus to deepwater and LNG, greenfield conventional projects like OMLs 74 and 77 are not priority. As a result, we have downgraded the assets to non-commercial. We believe that if a licence renewal is secured, then Shell may opt to divest the blocks.

OML 68OML 68 is one of four shallow water production licences that form the Joint Venture (JV) between NNPC and Mobil Producing Nigeria (MPN), a wholly-owned subsidiary of ExxonMobil. It is the smallest of these by reserves and area. It has four producing fields: Ata, Idoho, Idoho North and Inanga. Production on Idoho started in 1970, followed by Inanga in 1995 and Idoho North in 2007. The small Ata field cameonstream in 2012. Early production was stored in an offshore storage tanker

OML 70OML 70 is one of the four shallow water blocks which form the Joint Venture (JV) between NNPC and Mobil Producing Nigeria (MPN), a wholly-owned subsidiary of ExxonMobil. The first commercial discovery, Usari, was made in 1964. Since then, 24 fields have been discovered on the block, although only 11 have been developed. Production began in 1970 from the Asabo field. Volumes were stored in an offshore tanker until 1971, when the onshore Qua Iboe oil terminal was completed.

OML 79 (EA Area)OML 79 is located in the western delta and has two producing fields EA and EJA which are located in water depths of 15 to 30 metres. The fields provide the only offshore production from the Shell/NNPC JV. The initial development used an alternative funding arrangement whereby NNPC’s capital costs were carried by Shell and Eni. Production started in 2002 from three unmanned drilling and production platforms: DP-A and DP-B on the EA field and DP-J on EJA.

OML 104 (Yoho &Awawa)Yoho and Awawa are located on the shallow water OML 104, which is part of the NNPC/ExxonMobil JV. OML 104 is the only OML within the JV that does not use the Qua Iboe terminal for crude exports. Following final investment decision, Yoho was developed through an early production system (EPS) consisting of the Falcon FPSO and a wellhead platform. This initial development was financed under an alternative funding (AF) mechanism rather than through the JV budget allocations. As a result, …

Please wait....

Thank you for subscribing...