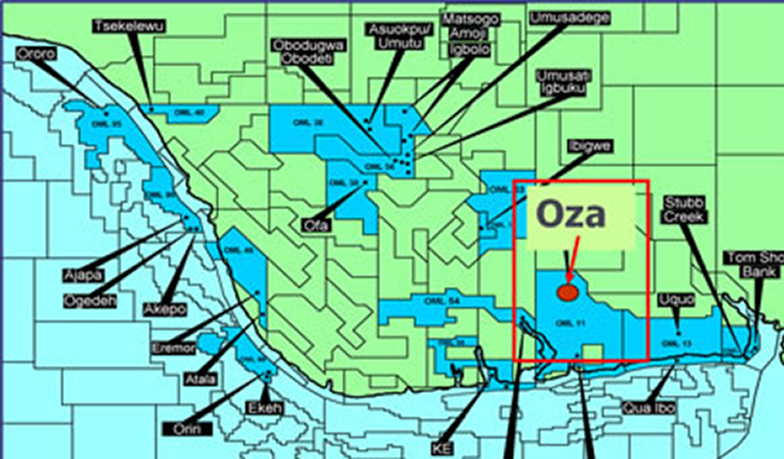

San Leon, the independent oil and gas production, development and exploration company focused on Nigeria, today announced that its investment in the Oza oil field in Nigeria (“Oza”) is now proceeding with the following amendments.

On 1 September 2020, San Leon announced that it had conditionally agreed to provide a US$7.5 million loan to Decklar Resources Limited (“Decklar”), via 10% per annum unsecured subordinated loan notes of Decklar. Decklar is the holder of a Risk Service Agreement with Millenium Oil and Gas Company Limited in relation to Oza. San Leon also announced that it would conditionally subscribe for a 15% equity interest in Decklar at nominal value.

As previously announced, US$6.75 million of San Leon’s proposed investment remained in escrow and was to be released upon satisfaction (or waiver) of certain conditions precedent. Despite delays to concluding the transaction documents, Decklar has performed the workover of the Oza-1 well, the results of which have already been announced by San Leon. In summary, the Oza-1 well test has indicated positive oil results from the lowermost zone, encountered gas in the middle zone and oil in the uppermost zone. San Leon has evaluated these results and the San Leon Board has recommended that it proceeds with an investment in Oza. Decklar is in agreement with that strategy and also to fully involve San Leon in future development planning and determining the location of the first new well to be drilled on the Oza Oil Field.

Accordingly, San Leon has entered into an amendment to its original agreement with Decklar, the principal terms of which are:

- San Leon has agreed to proceed with its investment in Oza, waiving the remaining conditions precedent.

- Of the US$6.75 million of funds held in escrow, US$4.75 million has now been released to Decklar and US$2.0 million has been returned to San Leon pending final completion. San Leon is obliged to either provide a further loan of US$2.0 million to Decklar by 30 April 2022 or, alternatively, accept a pro rata reduction in its shareholding in Decklar.

- San Leon has agreed to waive its option to invest an additional US$7.5 million in Decklar.

The transactions contemplated by the Subscription Agreement and Binding LOI are subject to final approval by the TSX Venture Exchange.

San Leon has previously advanced US$750,000 to Decklar as an initial deposit. As a consequence of the above transactions, upon completion San Leon will be interested in US$5,500,000 of 10% unsecured subordinated Decklar loan notes and a 11.5% equity interest in Decklar, which will be subscribed for at a nominal value of N 1,294,118 (approximately US$3,400). The key terms of the loan notes remain unchanged from those described in the Company’s announcement of 1 September 2020.

In its audited accounts for the year ended 31 December 2020, Decklar reported a loss before tax of US$5.1 million and total assets of US$6.0 million. San Leon will be entitled to one seat on the board of Decklar.

Oisin Fanning, CEO of San Leon Energy, commented:

“Our investment in Oza has taken longer to conclude than originally anticipated, but Decklar’s advancement of the project in the interim period means that we are now committing funds on the back of greater clarity around the field performance, which should de-risk the project for San Leon. We look forward to working more closely with Decklar on the next stage of development.”