FAR Limited has received notice from Remus Horizons PCC Limited advising its intention to make a takeover offer for FAR shares at 2.1 cents per share.

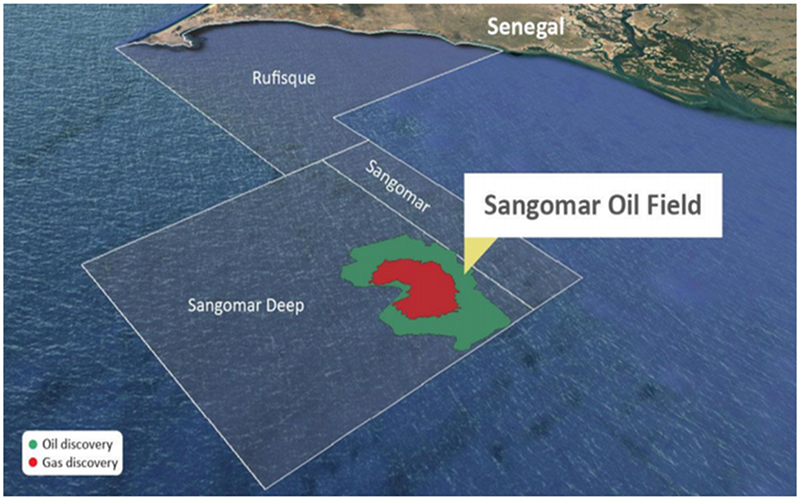

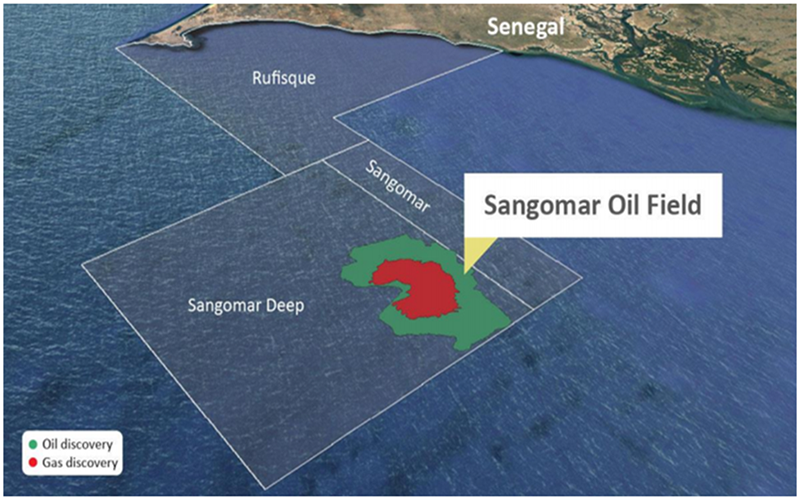

The Remus Offer is conditional only upon FAR and/or its subsidiaries not proceeding with the proposal to sell the Rufisque, Sangomar and Sangomar Deep (RSSD) Project to Woodside and FAR or any of FAR’s subsidiaries otherwise disposing of the RSSD Project, agreeing to dispose of, granting or agreeing to grant any other right or entitlement the effect of which would result in the disposal or loss of control of FAR’s interest in the RSSD Project or any of its assets which has a book value of more than US$5 million.

FAR shareholders are due to consider approving this sale at a shareholders’ meeting which has been convened on 15 April 2021.

The FAR Board recognises that FAR shareholders are likely to want an opportunity to consider the implications of this prior to voting on the sale resolution.

Accordingly the FAR Board intends to address this development as the first item of business at the meeting, including whether shareholders would seek more time to consider its implications.

Funding

Remus has a present funding capacity totalling US$400 million of which it has currently allocated up to US$250 million towards the acquisition of FAR and the provision of additional funds to FAR post the completion of the acquisition or through a potential working capital support bridge loan. This being more than sufficient to fund the total consideration payable to Shareholders under the Remus Offer of approximately A$210 million.