The discussions are over blocks in nations including Namibia, South Africa and Angola, Petroleo Brasileiro SA’s head of exploration and production, Sylvia dos Anjos, said in an interview.

Petrobras is studying a total of 10 opportunities to partner with oil majors in Africa as the Latin American company tries to capitalize off its expertise in developing deepwater wells, Anjos said.

Galp Energia SGPS SA’s Mopane oil and gas field in Namibia is one of the options where Petrobras is looking to buy a 40% stake to becoming the operator of the promising offshore discovery.

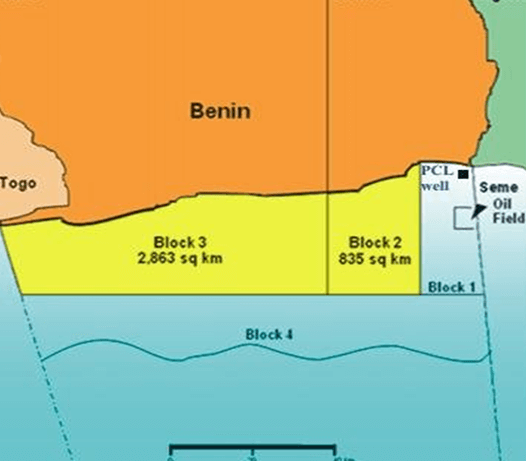

Latin America’s largest oil producer recently acquired minority stakes in three blocks from Shell in Sao Tome and Principe, two volcanic islands off the coast of central Africa that have shown geologic similarities to Guyana.

Galp, Exxon, Shell and Equinor declined to comment. TotalEnergies didn’t immediately respond to requests for comment.

The move into Africa is part of a wider shift at Petrobras, which had been focusing exclusively on deepwater fields offshore Brazil in the so-called pre-salt region. Most of the commercial discoveries were made earlier this century and recent exploration has largely fallen flat, encouraging Petrobras to move into other basins in Brazil and abroad. Apart from Africa, Petrobras is also looking at Argentina’s Vaca Muerta shale region, Anjos said.

Similar geology. Brazil has areas that are geologically similar to Namibia, where there’s optimism that it could turn into another Guyana where a giant oil discovery has transformed the economy of a sparsely populated country.

Africa was connected to South America before the two continents started separating 100 million years ago, and as a result, the geology on the other side of the Atlantic is a natural choice for Petrobras.

Shell Chief Executive Officer Wael Sawan met with President Luiz Inacio Lula da Silva in New York this week in a sign of increased cooperation. Meanwhile TotalEnergies Chief Executive Officer Patrick Pouyanne said at a conference in Rio de Janeiro that it is open to partnering with Petrobras abroad.

“He knocked on our door,” Anjos said.

Vaca Muerta. Anjos confirmed Petrobras is looking for deals in Argentina’s heralded Vaca Muerta shale patch as part of a plan to increase natural gas supplies and has held talks with Tecpetrol SA and YPF SA who are looking to share development costs with a partner, she said. Petrobras seeks to boost natural gas imports through Bolivia to supply local industry, power plants and to kick start fertilizer production.

“We’ll assess feasibility and risks. It’s part of the deal for us to guarantee our own gas,” she said.

YPF declined to comment. Tecpetrol didn’t immediately respond to a request for comment.

The funds to finance any deals would come from the $11 billion that the state-controlled firm has set aside for acquisitions in its $102 billion five-year spending plan.

Petrobras’s exploration and production chief ruled out returning to Venezuela. The state-run oil giant sent a delegation to visit oil fields in the country at the request of President Nicolás Maduro, but according to Anjos, the areas offered have too many environmental problems.

“It’s not just about politics. Lake Maracaibo makes you want to cry with so much oil,” she said. “Petrobras cannot expose itself in such an environment.”

She said a top priority for Petrobras is getting permits to explore the Foz do Amazonas basin in Brazil’s so-called Equatorial Margin where the industry has expectations for similar discoveries to what Exxon found in Guyana.