TAG Oil has provided the company’s latest operational update as it initiates Phase 1 of strategic development program of the unconventional Abu Roash “F” (“ARF”) reservoir in the Badr Oil Field (“BED-1”) over the first half of 2023, These strategic initiatives comprise the following as heighted below.

First Well Re-Completion

TAG Oil has chosen the BED 1-7 vertical well for its first re-completion and evaluation operations in BED-1. The well had previously tested at a peak rate of 418 barrels of 24ᵒ API oil and produced ~20,000 barrels of oil from the ARF during a one-year production period before being suspended.

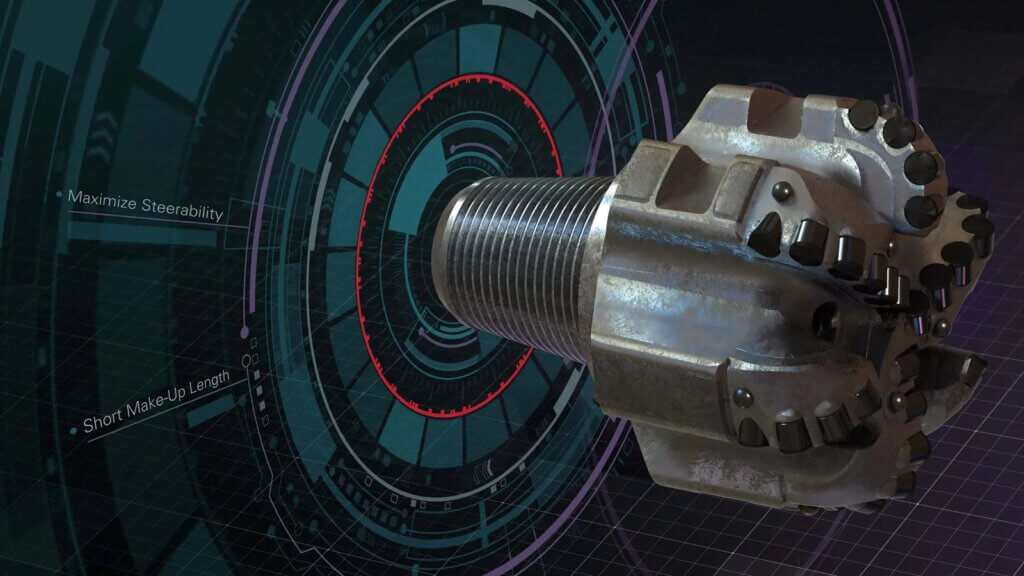

The first stage of operations will involve conditioning the open-hole section of the well with a production liner, re-completing the ARF and conducting a Diagnostic Fracture Injection Test (DFIT) to provide information on the geo-mechanical properties and imaging the natural fracture network in the ARF reservoir. This will be followed with hydraulic fracture stimulation to improve permeability and productivity, flow-back and a production cycle to assess the potential of oil recovery from the ARF. Services and equipment for these operations are being secured, which TAG Oil has scheduled to be in place for operations to commence in mid-January 2023. The Company anticipates being able to provide well results in March 2023.

First Horizontal Well

The data that is collected from BED 1-7 and incorporated into the modeling studies will help facilitate plans for drilling the first horizontal ARF well in BED-1. The Company has submitted the requisite drilling and environmental permits for the first well and anticipates that a drilling rig will be secured and ready to spud in the period of May/June 2023. TAG Oil will be observing production performance of these two wells and will likely plan to drill one more horizontal well in Q4 2023 or early in 2024. TAG Oil also announced the grant of 1,150,000 stock options that are exercisable for a period of five years at a price of C$0.70 per share to various staff members and certain officers.