With a recognized net income amounting to $21.9 million In Q1 2023, the Company is no doubt making tremendous progress in its Africa oilfields investment campaign. Africa Oil Corp. operations in Nigeria are ceaseless with its latest OML 130 drilling campaign which commenced on February 22, 2023, with the spud of the first infill well on the Egina oil field. This is the first well in a multi-well program that is planned for up to 9 wells on Egina and Akpo in the license area during 2023 and 2024

Namibia Orange Basin – Venus Oil Discovery

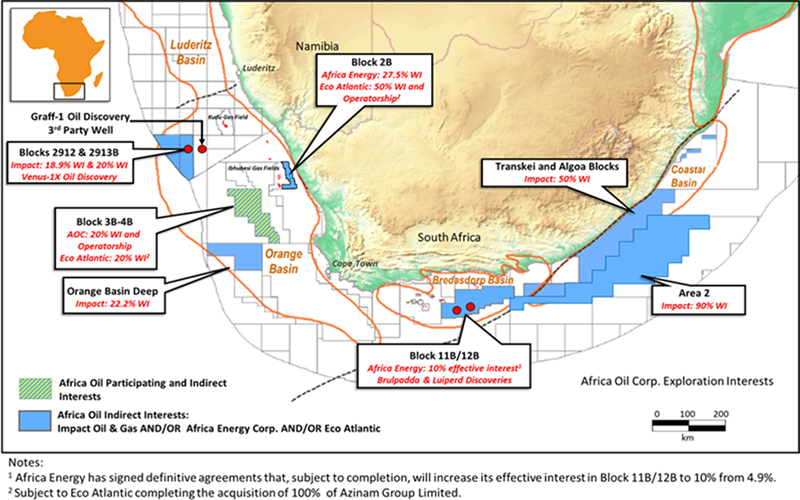

The multi-well appraisal and exploration campaign in Namibia’s Orange Basin commenced on March 4, 2023. This program is targeting up to four wells (including the re-entry of Venus-1X discovery well, in Block 2913B), to appraise the Venus light oil discovery and to investigate a potential westerly extension of Venus, the Nara prospect on Block 2912.

Africa Oil has an interest in this program through its shareholding in Impact Oil and Gas Ltd. (“Impact”), which in turn has a 20.0% WI in Block 2913B and a 18.9% WI in Block 2912, giving Africa Oil effective interests of 6.2% and 5.9% in these blocks respectively. Africa Oil is the only publicly-listed Independent E&P company with an effective economic interest in Venus, understood to be the world’s largest oil discovery in 2022.

Impact closed an Open Offer to its shareholders on April 27, 2023, to raise $95.0 million. The proceeds from the Open Offer, together with Impact’s existing cash reserves will be used to fund Impact’s share of the 2023 drilling and DST campaign.

South Africa

On March 8, 2023, the Company published an independent review of prospective resources in Block 3B/4B by RISC Advisory (UK) Limited (“RISC”). This was prepared in accordance with Canadian National Instrument 51-101 – Standards for Oil and Gas Activities (“NI51-101”), the Canadian Oil and Gas Evaluation Handbook (“COGE Handbook”) and the Petroleum Resources Management System 2018 (“PRMS”).

RISC reviewed the prospective resources and probability of geological success of an inventory of exploration prospects within Block 3B/4B and reported total unrisked gross P50 prospective resources of approximately 4 billion barrels of oil equivalent. Please refer to the Company’s press release of March 8th, 2023, announcing the publication of this report for more details. The independent review can also be found on the Company’s website: https://africaoilcorp.com/operations/block-3b-4b/ .

The Company and its JV partners are progressing plans to conduct a two-well campaign on Block 3B/4B and are in discussions with various potential partners to farm out up to a 55% gross working interest in the Block. The JV Partners have selected a leading South African environmental consulting firm to conduct a comprehensive Environmental and Social Impact Assessment (“ESIA”) process in preparation for permitting and drilling activity on the Block.

Equatorial Guinea

In the three months ended March 31, 2023, expenditure of $7.7 million was incurred following the signing of the PSCs for Blocks EG-18 and EG-31 and mainly related to the acquisition of seismic data. On February 20, 2023, the Company announced that it had signed two Production Sharing Contracts (“PSCs”) with the Republic of Equatorial Guinea for offshore Blocks EG-18 and EG-31, which were subsequently ratified on March 1, 2023. The Company holds an 80% operated interest, subject to back in rights by GEPetrol in both blocks. Work programs on both blocks include re-processing of existing 3D seismic surveys and identification of prospects within the first 2-year period. The initial period provides a low-cost opportunity in two highly prospective blocks.

Africa Oil President and CEO Keith Hill commented:

“The Venus appraisal program is progressing per our expectation with a second rig, DeepSea Mira, expected to arrive in Namibia shortly to join the campaign. As already reported, we stood our corner in Impact’s Open Offer and will ultimately increase our shareholding in Impact to 31.1%. The interest in Impact provides our shareholders with material exposure to, possibly the most exciting appraisal and exploration work program globally during 2023. We remain the only publicly-listed Independent E&P company with exposure to Venus and its possible westerly extension that will be explored later this year. I am pleased that first quarter 2023 was another robust quarterly period for Prime as demonstrated by its EBITDAX and cash from operations metrics. We have high quality production assets in Nigeria, held through our shareholding in Prime and, these are complemented by our exciting and potentially high impact exploration assets. These include attractive infrastructure-led exploration opportunities in Equatorial Guinea, together with our Block 3B/4B exploration inventory in the Orange Basin, that lie on trend with the recent oil discoveries offshore Namibia