Panoro Energy has announced record full-year financial performance in 2022 with revenue up 58 percent year-on-year at USD 188.6 million and EBITDA up 78 percent year-on-year to USD 126.6 million. The Company has maintained a conservative leverage profile with net debt of USD 46.8 million at year end representing a net debt to EBITDA ratio of just 0.37x.

In line with its previously communicated 2023 Shareholder Returns Policy the Company has today declared an inaugural quarterly cash dividend of NOK 0.2639 per share to be paid on or around 16 March 2023 (equivalent to a cash payment to shareholders of approximately USD 3 million).

Production drilling on the first of six Hibiscus Ruche Phase I development wells offshore Gabon commenced in January and is progressing according to plan. Panoro’s working interest production is expected to build to a peak of 12,500 bopd around year end once all six new wells are onstream. The next three well infill drilling campaign at Block G offshore Equatorial Guinea is scheduled to commence in Q4.

Equatorial Guinea – Block G (Panoro 14.25%)

In E.G the company working interest production in the fourth quarter averaged 3,954 bopd (27,746 bopd on a gross basis) and for the full year averaged 4,402 bopd (30,895 bopd gross). While the rig contracted for a three well infill drilling campaign which is expected to commence in Q4 2023

The company has outlined Workovers operations which are including an electrical submersible pump (“ESP”) conversion and behind pipe perforations and ongoing field life extension and asset integrity projects also including flowline replacements.

Other project of execution including, Gas compression project at Okume and Plan for future gas injection project to reduce routine flaring

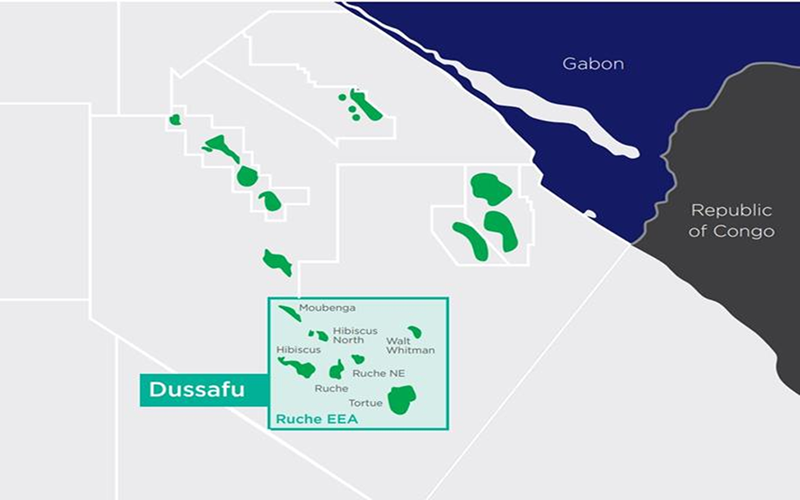

Gabon – Dussafu Marin Permit (Panoro 17.5%)

In Gabon, the company working interest production in the fourth quarter averaged 1,680 bopd (9,602 bopd on a gross basis) and for the full year averaged 1,852 bopd (10,582 bopd gross).

Production drilling at the first of six Hibiscus Ruche Phase I development wells has commenced in early January and is scheduled to come onstream around the end of Q1 in line with previously communicated guidance.

The company’s nstallation of flexible pipelines and risers between the BW MaBoMo production facility and the FPSO BW Adolo has been completed with final hook up and commissioning work being undertaken in Q1.

New gas lift compressor unit to support production from the six existing wells on the producing Tortue field is being installed onboard the FPSO BW Adolo with commissioning and startup of the compressor expected around the time of first oil from Hibiscus Ruche Phase I

Tunisia – TPS Assets (Panoro 29.4%)

In Tunisia operations, the company working interest production in the fourth quarter averaged 1,365 bopd (4,644 bopd on a gross basis) and for the full year averaged 1,244 bopd (4,232 bopd gross)

Recompletion of the GUE-10AST well on the high potential Douleb reservoir and Cercina workover campaign comprising ESP replacement and stimulation of three wells: CER-1; CER-6A; and CER-7 in progress.

Detailed planning for development drilling campaign on the Rhemoura and Guebiba fields with operations expected is slated to start at year end

Exploration

Panoro does not have any exploration wells planned during 2023 and has been awarded a 56 percent operated interest in Block EG-01 offshore Equatorial Guinea. The award for an initial period of three years during which the partners will conduct subsurface studies based on existing seismic data to further define and evaluate the prospectivity of the block. Following this, the partners will have the option to enter into a further two-year period, during which they will undertake to drill one exploration well.

Having reached agreement to farm into a 12 percent interest in Block S offshore Equatorial Guinea (subject to customary approvals) the partners are planning to drill the Kosmos Energy operated Akeng Deep exploration well in 2024 to test a play in the Albian, targeting an estimated gross mean resource of approximately 180 million barrels of oil equivalent in close proximity to existing infrastructure at Block G.

Further exploration wells at Dussafu in Gabon are also being considered, using the optional wells slots under current contract , as Complete study is in course to evaluate the helium and natural gas prospectivity of Technical Co-operation Permit 218 onshore northern Free State, South Africa “Following a record year in 2022, in which Panoro consolidated its position as a significant independent oil producer in Africa, we have now entered an intensive phase of organic growth with continual drilling activity which will see at least 10 wells being drilled in Gabon and Equatorial Guinea over the next 12 to 15 months. This drilling programme will transform Panoro’s working interest oil production. We are also pleased to commence dividend payments with Panoro’s inaugural cash dividend declared today and to be paid in March 2023. We remain fully committed to convert the strong fundamentals and cash generative potential of Panoro’s high-quality asset base into sustainable shareholder returns whilst maintaining our growth “ John Hamilton, CEO of Panoro, commented.